The Weighted Average Cost of Capital Calculator – WACC offers the ability to determine the required level of company profitability to generate total value. Using the formula to calculate WACC, you can get the required results. In the following article, you will learn more about the importance of using this calculator in real life and its relationship to other terms.

Furthermore, you can find more detailed information about other related CalCon calculators on our site. You can find answers to questions about what invested capital is or how to calculate operating cash flow.

Take a look other related calculators, such as:

- Finance charge calculator

- Net to gross calculator

- Markdown calculator

- Hourly to salary calculator

- Gdp per capita calculator

- Fte calculator

- Margin with discount calculator

- Average rate of change calculator

- Magi calculator

- Consumer surpulus calculator

- Double discount calculator

- Net effective rent calculator

- Marginal Cost calculator

- MPC calculator

- MPS calculator

- Pay Raise calculator

- Pre-Money and Post-Money Calculation

- Stock Calculator

WACC – Meaning?

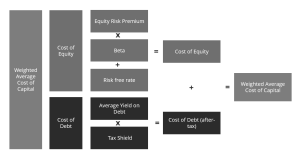

You can finance the company from debt or capital. In the best case, we recommend you to use a combination of the cost of debt and capital in one measure. The weighted average cost of capital (WACC) determines the company’s profitability. It represents the average cost of capital of a company that considers all types of stocks, bonds, and other forms of debt. It is a standard method to determine the rate of return that you can express in one number.

Companies will result in a higher amount of WACC if their shares are volatile or if the debt is too risky, which aims to demand higher returns. You can proportionately weigh each category and type of capital to this extent.

You can also use it as a marginal rate through which companies and investors can assess the acceptability of a project. The critical segment of determining the company’s capital prices is the WACC. It can help you analyze the potential benefits of downloading specific projects. A company’s WACC results can help you determine if a particular merger with another company will result in a higher return than the cost of capital.

The lower value of WACC provides an overview of a healthy way of doing business that can attract the attention of investors. Otherwise, a higher value of the company’s WACC is, in most cases, considered a risky option.

WACC Formula

You can use the following formula to calculate the weighted average cost of capital:

WACC = \frac{E}{V}\cdot R_{e}+\frac{D}{V}\cdot R_{d}\cdot (1-T_{c})where:

E – denotes the equity value of the company

D – means the value of the company’s debt

Re – refers to the cost of equity

Rd – represents the cost of debt

Tc – denotes the income tax rate

V is equal to the sum of the values of E and D, i.e., the total market value of equity and debt.

The formula for calculating the WACC involves the sum of two parts. The first part refers to the share of finance based on the use of stakes. This part represents the weighted value of equity capital. At the same time, the second part describes the share of finance you base based on the value of debt. The second part of the formula refers to the weighted value of debt. Learn more about equity with this Return on Equity Calculator.

The process of calculating the cost of equity (Re) can present difficulties due to the lack of exact value of share capital. The cost of capital represents the total amount of return that the company generates to maintain the current share price. The use of a capital pricing model, also known as CAPM, will help you with this calculation. On the other hand, calculating the cost of debt (Rd) is far simpler. You can do this by calculating the average yield to maturity for company debt. In most situations, you can use this measure to calculate the amount of the cost of debt after the taxation process.

WACC vs. Required Rate of Return (RRR)

The WACC is a method that helps you identify the required rate of return (RRR). Since WACC considers the company’s capital structure when calculating, this is one of the key advantages of its application. In addition, the WACC helps to find the required rate of return or the minimum amount of return required by the investor.

Another method of determining RRR is by using CAPM calculations. This is also a useful method because CAPM uses the share price volatility concerning the market when calculating.

Weighted Average Cost of Capital – How to Calculate WACC?

You can perform the WACC calculation process by applying the formula and the following steps. First, you need to find two essential elements to add to the formula. This refers to the market values of capital and equity debt. It is also necessary to determine the company’s equity value (E) and debt (D).

To calculate the value of V, you need to sum up the amounts E and D. The next step involves finding the exact tax rate applied by the company. Then you need to convert the percentage of the tax rate amount to a decimal notation when calculating the WACC. The last step considers inserting all the values in the formula, which will give you the necessary results. Weighted value always provides insight into the cost of capital that a company needs to cover to remain profitable.

WACC Calculator – Example

To make it easier to calculate the WACC value, you can use our calculator. Like all other CalCon calculators, this one also contains specific blank fields where you need to enter values. Our calculator calculates WACC using the following formula:

WACC = \frac{E}{E+D}\cdot C_{e}+\frac{D}{E+D}\cdot C_{d}\cdot (100-T)where:

E – company equity

D – company debt

Ce – represents the cost of equity

Cd – means the cost of debt

T – stands for company tax rate

The following example will show how you can calculate WACC.

It is necessary to determine the amount of initial capital, which is, for example, $500,000. The amount of debt incurred in your company is $350,000. The assumption is that the cost of equity is 12%, and the cost of debt is equal to 5%. Let’s assume the income tax rate is 22%. Enter all the specified values in the calculator.

Following the formula, resulting value of WACC is 8.665%.

WACC Calculator – Real-world Applications

Many financial sector analysts often take advantage of WACC calculations. You can use WACC when performing regular financial analysis in the field of investment banking, capital research, or corporate development. Many companies apply this measure to assess investment opportunities, as WACC is an opportunity cost for a corporate. It is not uncommon for companies to use WACC for barrier rates when evaluating mergers and acquisitions or in the case of financial investment modeling.

FAQ

What Weighted Average Cost of Capital (WACC) mean?

When you want to calculate the total cost of capital of a corporation, you can use the weighted average cost of capital – WACC.

Who Uses Weighted Average Cost of Capital?

Companies, investors or huge corporate use the weighted average cost of capital as a tool to assess the possibility of investing in a particular business.

How to find WACC?

You can calculate the WACC by finding the product of the cost of capital sources (including its relevant weight) with the market value. After that, it is necessary to add up the values to obtain the total value.

What is a good WACC?

Achieving a lower WACC value signifies that companies can finance future projects cheaper. So this represents the “good” WACC. Otherwise, if the company reaches a higher amount of WACC, it will pay more to raise the required capital.

How does WACC affect the discount rate?

You can use the weighted average cost of capital measure – WACC as a function of the discount rate, to calculate a company’s NPV. Or just try our calculator.