The consumer surplus calculator is a useful tool for calculating the gap between what consumers are willing to pay. We use it for a commodity, also a service and the market price. You can discover what consumer surplus is based on the consumer surplus definition if you continue reading. We will also demonstrate how to use the consumer surplus formula to calculate consumer surplus.

Take a look other related calculators, such as:

- Finance charge calculator

- Net to gross calculator

- Markdown calculator

- Hourly to salary calculator

- Gdp per capita calculator

- Fte calculator

- Margin with discount calculator

- Average rate of change calculator

- Magi calculator

- Consumer surpulus calculator

- Double discount calculator

- Net effective rent calculator

- Marginal Cost calculator

- MPC calculator

- MPS calculator

- Pay Raise calculator

- Pre-Money and Post-Money Calculation

- Stock Calculator

What is consumer surplus?

The term “consumer surplus” refers to an economic evaluation of consumer advantages. When the price that consumers pay for a product or service is less than the price that they are willing to pay. This is a consumer surplus. It is a measure of the additional advantage. That customers obtain due to paying less than they prepare to pay for something.

In 1844, the notion of consumer surplus was devised to quantify the social advantages of public goods such as national roads, canals, and bridges. It has been a useful instrument in studying welfare economics and the creation of government tax policy.

Further, the concept of consumer surplus is founded on the economic theory of marginal utility, which is the additional satisfaction gained by a customer by purchasing one more unit of an item or service. The usefulness of a good or service varies from person to person, depending on their particular preferences.

How to calculate consumer surplus?

Consumer surplus is an economic statistic that calculates the benefit (i.e., surplus) of what consumers are prepared to pay for a commodity or service in comparison to its market price. Also, the consumer surplus formula is based on the marginal utility theory of economics. Individual preferences influence spending behavior, according to the hypothesis. A surplus is formed when different people are ready to spend differently on a particular commodity or service. This statistic is employed in a variety of corporate finance occupations.

Consumer surplus formula

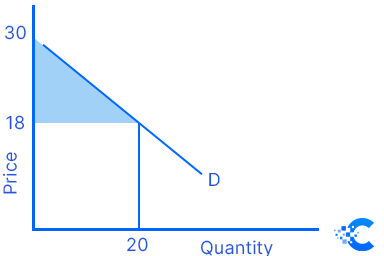

The equilibrium price is the point at which demand and supply meet. Product surplus (PS) refers to the region above the supply level and below the equilibrium price. In contrast, consumer surplus (CS) refers to the area below the demand level and above the equilibrium price (CS).

The consumer surplus is calculated using an economic formula that takes the difference between consumers’ highest price and the actual amount they pay.

Furthermore, here’s how to calculate consumer surplus:

Consumer \; Surplus = Max \; Price \; Willing - \; Actual \; Price

To calculate the consumer surplus for a whole economy, you’ll need to use a slightly modified version of the formula, which you can find in the advanced mode of our consumer surplus calculator.

Consumer \; Surplus \; Extended = 0,5 \times Q_d - P_{max} - P_dWhere:

- When demand and supply are equal at equilibrium, Qd is the quantity required.

- Pmax denotes the buyer’s maximum willingness to pay; and

- Pd denotes the price at which demand and supply are equal.

Consumer surplus graph

The area under the demand curve (see graph below) that shows the difference between what a customer is willing and able to pay for a product and what the customer actually pays is known as consumer surplus.

Consumer surplus – an example

For example, let’s assume you paid $100 for a plane ticket to Disney World during school vacation week, but you expected and were prepared to spend $300 for one ticket. The $200 is the amount of money you have left after paying all your bills.

FAQ

How to calculate total consumer surplus?

A horizontal line drawn between the y-axis and the demand curve depicts the space below the downward-sloping demand curve, or the amount a customer is prepared to spend for specific quantities of an item, and above the actual market price of the good.

Price floor consumer surplus?

When a price floor is set higher than the equilibrium price, buyers will have to pay more for the goods. As a result, fewer people will buy the goods since they will decide that the usefulness it provides is not worth the price. This, unavoidably, represents a decrease in consumer excess.