Today we present you a Marginal Cost Calculator. This calculator helps you calculate the marginal cost incurred by adding the additional inputs needed to produce the following product units. If you know the current cost, future cost, and quantity data, you have everything you need to enter in the calculator and calculate the marginal cost. If you are interested in how the calculator works and which formula is used, continue reading the article.

When understanding the concept of marginal costs, it is necessary to understand their purpose of use to maximize profits and reduce the unit cost of production. The term marginal cost is used as a fundamental principle of economic theory. It is most often used in analyzing the financial success of a company when assessing the price of goods and services.

If you want to see related calculators and subjects, head to our MPC Calculator, which converts the marginal propensity to consume, but don’t miss the MPS Calculator, to convert marginal propensity to save. Also, you can calculate the markdown, but also the net effective rent or learn about GDP per Capita with our available tools. There is one more interesting tool for calculation of the Pay Raise.

Take a look other related calculators, such as:

- Finance charge calculator

- Net to gross calculator

- Hourly to salary calculator

- Fte calculator

- Margin with discount calculator

- Average rate of change calculator

- Magi calculator

- Consumer surpulus calculator

- Double discount calculator

- Marginal Cost calculator

- Pre-Money and Post-Money Calculation

- Stock Calculator

What is the marginal cost?

The term marginal cost defines the additionally realized production cost for each additional unit. It comes from production costs that include both fixed and variable costs. When it comes to fixed costs, they need to be included in marginal costs in case of expansion of production. While on the other hand, variable costs are always included in the calculation of marginal costs.

Marginal costs are an essential element of calculation in companies, as they can help maximize profits. They are used as such in economics and accounting. By including marginal costs in the calculation formula, materials and labor need to be considered. If, after the calculation procedure, which we will talk more about below, we get an amount equal to the marginal revenue, then we have achieved profit maximization.

Therefore, the conclusion is that the cost of production of additional units equals to the income from the sale. Variation of marginal costs is possible with declining enterprise productivity and the impact of economies of scale.

How to calculate the marginal cost?

Before the necessary steps for calculating the marginal cost, we first need to introduce you to the basic concepts:

- Change in total costs – During the production process, costs can be reduced or increased at any level. This is likely to decline further or increase production volume. If you need to hire several new workers to meet the desired production volume, this will lead to a record of changes in costs. It is determined by subtracting the production costs accumulated during the first batch of products from the production costs of the next set or cycle.

- Change in quantity – Following the previously explained concept, we conclude that the amount of products also changes at certain production levels, whether increasing or decreasing. To calculate the change in quantities, you need to subtract the number of goods produced in the first production cycle from the number of goods in the next, further extended production cycle.

After clarifying the elements of the marginal cost calculation formula, the steps that need to be done are related to finding out how much the costs will increase after the production of the additional unit. After that, you need to consider how many different units you plan to spend. The additional cost you incurred from the first step needs to be divided by the number of other units you plan to produce from the second step.

Marginal cost formula

The formula for calculating the marginal cost consists of two key elements. If you decide to use a marginal cost calculator, all you have to do is enter the given data into the calculator, and it will calculate the final result for you.

MC = \frac{\Delta TC}{\Delta Q}where:

- MC – marginal cost;

- ΔTC – change in the total cost;

- ΔQ – change in the quantity

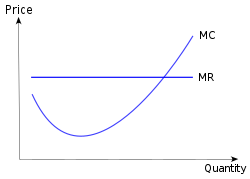

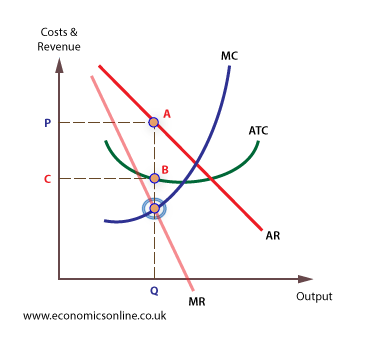

Marginal cost curve

In economic theory, marginal cost is widely used as an indicator of maximizing production profits.

Where:

- MC is the marginal cost

- MR is marginal revenue

The graph shows that the firm’s supply curve is part of the marginal cost curve that passes above the average variable costs. In this case, we can interpret that you will not supply the company below point B because, it will not cover the opportunity cost. Point B is the point of exclusion, while point A is called profitability.

Marginal cost definition economics

From economic theory, marginal cost is interpreted as an essential element for analyzing profit maximization achieved in companies. The phenomenon of profit maximization refers to the situation when marginal costs are one marginal revenue. Marginal costs change directly with changes in the company.

This can occur due to excessive growth of the company, which continues to be inefficient in business. Also as a result of problems in the management of the workforce where workers become demotivated to work. Whatever the reason, companies must be prepared to deal with rising costs. Otherwise they will deal with the process of stopping production when it is no longer possible to realize it.

Marginal benefit vs marginal cost

And with this notion, confusion arises by confusing marginal benefit with marginal cost. These are two measures used to determine changes in the prices or values of certain products. Marginal benefit refers to the amount of money the consumer is willing to pay for additional goods produced. It decreases in proportion to the increase in consumption, i.e., the decision of consumers to consume more goods.

On the other hand, there is a marginal cost directly related to the producer of goods or services. This term is used to determine the point at which a company achieves economies of scale, creating one additional unit. In business, companies need to take both indicators into account.

Marginal cost example

We use the formula for calculating marginal costs to understand how it works in the real world. We can see this in the following example:

Let’s say it’s about a jewelry company that produces the products made of a particular type of rope and shells. The material needed to make it belongs to the group of variable costs, and the price of the material is $3. In addition to these costs, the company incurs fixed monthly costs of $1,700. Consider the situation that 850 pieces are produced monthly and that each product requires $2 of fixed costs.

The total price for each product was $5 per month, which we obtained by summing the fixed cost realized per unit with the variable cost per product unit. You can decide to increase this production to 1000 products every month over some time. Then each of the items in the range would have a fixed cost of $1.7. Then the total cost per case would be $4.7, which shows us that there has been a reduction in marginal costs.

FAQ

1. Marginal cost vs marginal revenue = what is the difference?

The difference between these two indicators is that the marginal cost (MC) shows the amount to produce another unit of a particular product. In contrast, the marginal revenue (MR) shows the money generated by the sale of that additional one unit of product.

2. What is the limit factor?

The term MFC marginal factor refers to the representation of the increase in total costs paid by aspects of production incurred due to the rise in the number of elements of production required per unit. It is most often expressed as work per unit time.

3. What does marginal resource cost mean?

The marginal cost of resources, the MRC, shows the cost that a company would incur by purchasing a single unit of resources needed to produce certain goods. Additional resources are considered sources of work, and the costs incurred relate to salaries to employees.