The field of economic sciences, especially the part of microeconomics, deals with the study of basic financial units. Also, understanding certain different principles in the sector of accounting and mutual financial monitoring can be of great help to you in your daily work. You can often come across the notion of marginal revenue, which companies use when calculating the increase in total revenue. This term directly refers to the increase in revenue generated due to the sale of products or services. In the continuation of the article, we will say something more on this topic and give some examples from practice.

Take a look other related calculators, such as:

- Finance charge calculator

- Net to gross calculator

- Markdown calculator

- Hourly to salary calculator

- Gdp per capita calculator

- Fte calculator

- Margin with discount calculator

- Average rate of change calculator

- Magi calculator

- Consumer surpulus calculator

- Double discount calculator

- Net effective rent calculator

- Marginal Cost calculator

- MPC calculator

- MPS calculator

- Pay Raise calculator

- Pre-Money and Post-Money Calculation

- Stock Calculator

What is marginal revenue?

The term marginal revenue represents the increase in revenue generated due to the sale of an additional unit of a product in the business. This is subsequently followed by the so-called law of diminishing returns, which will slow down in line with rising production levels. Explained in more detail, if your company’s revenue increases and if the number of units of product sold increases, marginal revenue will represent an increase per unit sold. Also, if you are in a situation to charge higher prices, you will sell fewer units of product, but your earnings will be higher for each item individually. Often companies examine the realized marginal revenues to determine the level of realized earnings. In the theory of economic sciences, perfectly competitive companies include those that continue to produce their range of products on the market until the marginal revenue is equated with marginal costs.

What is the difference between marginal cost and marginal revenue?

It is necessary to explain the connection of marginal cost with marginal revenue in more detail. Companies that want to maximize their profits will produce products where the marginal cost will be one marginal revenue. Suppose marginal revenue is realized below the number of marginal costs. In that case, this is a good sign that it is necessary to stop production and perform additional analysis of the costs incurred. In essence, the marginal cost of production means the change in the cost incurred in producing one other production unit. By analyzing marginal costs, a company can determine at what point in showing it will achieve economies of scale to optimize production and operations. This term represents an essential concept in accounting, as it serves as an aid in production optimization. The marginal cost includes all costs that change with the change in the level of production. If you realize that the marginal cost of production is lower than the price per unit of product, this will be a profit for you.

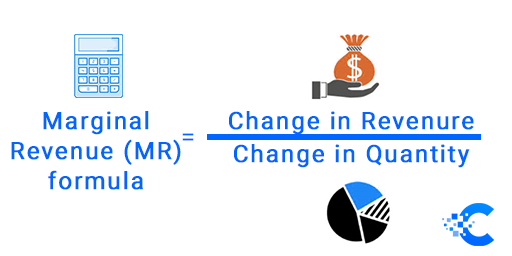

Marginal revenue formula

As we have clarified what is meant by the term marginal revenue, below we will define the marginal revenue formula, which reads:

Marginal \; Revenue \; (MR) = \frac {Revenue \; Change \; (ΔTR)} {Quantity \; Change (ΔQ)}In this case, the change in revenue refers to the increase/decrease in revenue for a certain period, and the change in quantity refers to the increase/decrease in the number of units in the same period.

How to calculate marginal revenue?

The process of calculating marginal revenue is straightforward. It is important to remember that marginal revenue is derived from the calculation of units sold. The previously presented formula divides the calculation of marginal revenue into two separate elements, the one related to the change in income and the other related to the change in quantity.

Marginal revenue – example

We can explain this very simply with a classic example:

imagine that one person A sells ten books a day. If person A decides to now sell 15 pieces of books daily, the previously earned total income would be $ 20, while it is now $ 28. When we enter this data into the formula, the change in revenue is $ 8, while the change in quantity is $ 5. Marginal revenue after book sales is $ 1.60 per book sold.

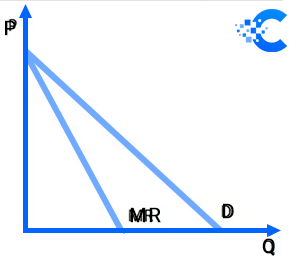

Marginal revenue curve

To have a complete insight into how the marginal passage is recorded and realized, we can also use a graphical representation of the marginal revenue curve. In the chart below, you can see the marginal revenue curve below the demand curve, as this is a situation where a manufacturer needs to lower the price to sell more products. Then we will get information from the graphs that the marginal revenue is lower than the product’s price. The marginal revenue curve has the shape of a straight line and has a much steeper slope than the demand curve, as shown in the graph.

How to calculate marginal revenue product?

An additional term you may encounter in the professional literature is the marginal revenue product labeled MRP. The phrase directly refers to the additional revenue generated by adding another product unit. It is essentially marginal revenue generated by using another unit of resource. It is based on the notion of marginalism, which is one of the basic concepts in economics. In addition to this term, we can mention marginal productivity, marginal utility, or the law of diminishing marginal yield. The term denotes the amount incurred during a change in total revenue. This additional revenue is used to determine the maximum price that a particular company is willing to set aside for another unit of resources.

The process of calculating the marginal revenue product can be realized using the formula which reads:

MRP = MPP \times MR

MRP means the product of marginal revenue obtained by multiplying the amount of marginal physical product (MPP) and realized marginal revenue (MR).

An example of using this formula can be seen in a simple example:

assuming Zack owns a pencil company. With the additional assumption that each different pen produced will cost $ 10, Zack knows that if he decides to hire a new employee, he will increase demand in that way. The new employee will produce an additional 200 unique pens pieces each week. If we multiply by the price of $ 10, we get the amount of $ 2,000, which represents the additionally generated weekly income called the marginal revenue product.

Can marginal revenue be negative?

So far, we have mentioned situations of achieving a positive marginal revenue. However, there is also a situation when we record a negative amount of marginal revenue. Suppose a company is faced with a situation where marginal revenue is less than average revenue. In that case, we will record this down the downward curve, where the amount may even be negative. This phenomenon occurs because when a company lowers the price, the revenue that the company could generate if it decides to sell the product at a higher price is mutually lost.

FAQ

When will we record marginal revenue as zero?

When the company cannot compete with the cost and operates with the so-called marginal loss, it makes a negative marginal profit, which will eventually lead to the cessation of production. Then when a company produces to a level where we can equate the amount of marginal cost with marginal revenue, marginal profit is equal to zero.

Are marginal revenue and profit the same terms?

Many find themselves in a situation to equate the meanings of these two terms. Marginal profit refers to the profit that the company makes after producing one additional unit. It is calculated by the difference between the marginal cost and the product. Thus, the name marginal cost means the cost realized by the production of each subsequent unit.