The Margin of Safety is a financial term that measures the number of sales that exceed the breakeven point. That being said, this calculator helps you know how your company is performing financially. Scroll down, and you have an essay that teaches you to calculate this margin in dollar, ratio and percentage terms to go along with our calculator.

Take a look other related calculators, such as:

- Finance charge calculator

- Net to gross calculator

- Markdown calculator

- Hourly to salary calculator

- Gdp per capita calculator

- Fte calculator

- Margin with discount calculator

- Average rate of change calculator

- Magi calculator

- Consumer surpulus calculator

- Double discount calculator

- Net effective rent calculator

- Marginal Cost calculator

- MPC calculator

- MPS calculator

- Pay Raise calculator

- Pre-Money and Post-Money Calculation

- Stock Calculator

What is the Margin of Safety?

Calculating the difference between budgeted and breakeven sales is important for all organizations. Figuring this can help them scale their performance and sales. So we can say that the Margin of Safety Calculator is used to estimate and ensure organizations that their budgeted sales are more significant than the breakeven sales. In other words, the margin represents a figure that helps organizations set prices for their products. It also helps them scale up their productivity and efficiency. Therefore, it is very important for the accounting and finance of a company. British-born American investor Benjamin Graham (the father of value investing), and his followers, notably Warren Buffet, popularized this principle.

How can this help us?

Learning how to calculate the margin of safety is very important for knowing the value of some stock and the financial analysis of a business. A high margin is preferred, indicating good business performance. On the other hand, a low margin indicates high risk, lousy position. Increasing the product price, growing sales volume, improving the contribution margin by reducing variable costs can also improve it. Also, you can adopt a more profitable mix of products. It is applied in two different terms, investing and budgeting.

Budgeting

In terms of budgeting, The Margin of Safety is the gap between the level by which a company’s sales could decrease and estimated sales output before turning the company unprofitable. For example, if an organization has a lower percentage of margin of safety, it might cause them to cut expenses. In contrast, a high spread of margins assures an organization that it is protected from sales variability.

Investing

Apart from protecting against possible losses, the margin of safety can boost the returns of specific investments. This is a principle of investing in which an investor purchases securities when their market price is notably below their expected value. The margin of safety secures the investor from an inaccurate market downturn. Before an investor buys a stock at a lower value, it is essential to determine the usual value. As for people who want to invest, a safety margin between 20% and 55% is reasonable. But knowing if the stock is good to buy is a special skill to learn and involves a lot of risk (The value of stock can’t just be determined by its margin).

How to calculate the margin of safety?

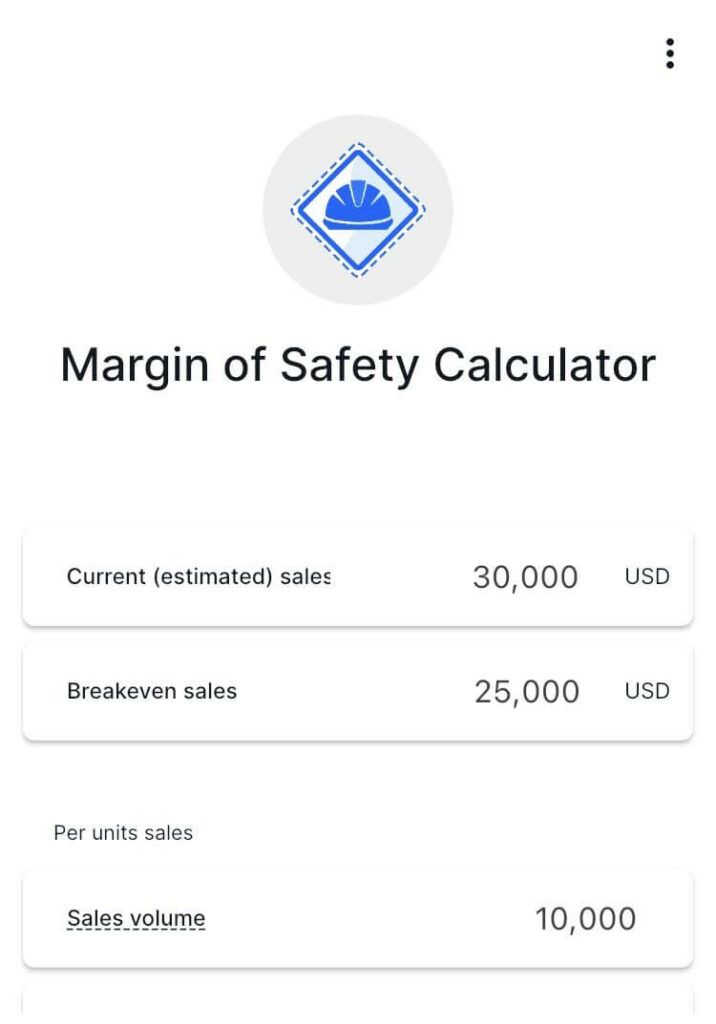

The margin of safety is very easy to calculate. One of the best things about calculating this is that you can learn to do all the analysis yourself. You don’t need any experience in accounting or finance. The easiest way to calculate this margin is by using our calculator “CalCon Calculator – Apps on Google Play“. Later in this text, you will see its formula, but the main component to calculate the margin remains the breakeven point calculation. Calculating it is the difference between two figures, so it is a simple matter of subtraction. The margin can be presented in product sales, unit terms, or percentage terms.

The margin of safety formula

It is a straightforward formula, and it can also be expressed in dollar amounts or number of units which we will show later on. So this is how you calculate it.

Margin\; of\; Safety=Current\; Sales\, -\, Breakeven\; Sales

The margin of safety formula in dollars

All the formulas that you will see are pretty much the same. So, for example, if you want to find out the margin of safety in dollars, you take away the number of breakeven sales from the number of current sales. So it is the same one that we showed in the last part of the text.

The margin of safety percentage

The margin of safety percentage is a simple method by which the margin is calculated. This percentage is significant because it presents the strength of the business. In addition, it helps the company evaluate the amount of gain and loss. Based on this, you can know whether your business is below or over the breakeven point.

This is the formula for calculating it.

Margin\; of\; Safety\; percentage=\frac{Current\; Sales\, -\, Breakeven\; Sales}{Current\; Sales\, }\;\; x100

The margin of safety ratio

Next to the percentage and dollar forms, the margin can also be expressed as a ratio. To calculate the ratio, we need to divide the margin of safety by actual or budgeted sales of the business. This is the ratio formula.

Margin\; of\; Safety\; ratio=\frac{The \; Margin \; of\; Safety}{Current\; Sales\, }The margin of safety in units

As we mentioned before, the last margin of safety calculation form is in unit terms. All you need to learn about this one is that it is used for measuring the profitability buffer zone in units produced and allows management to evaluate the production levels needed to profit. This form is similar to the dollar one.

Margin\; of\; Safety\; in\; units=\frac{Current\; Sales\, -\, Breakeven\; Sales}{Selling\; Price\;per \; Unit }The margin of safety examples

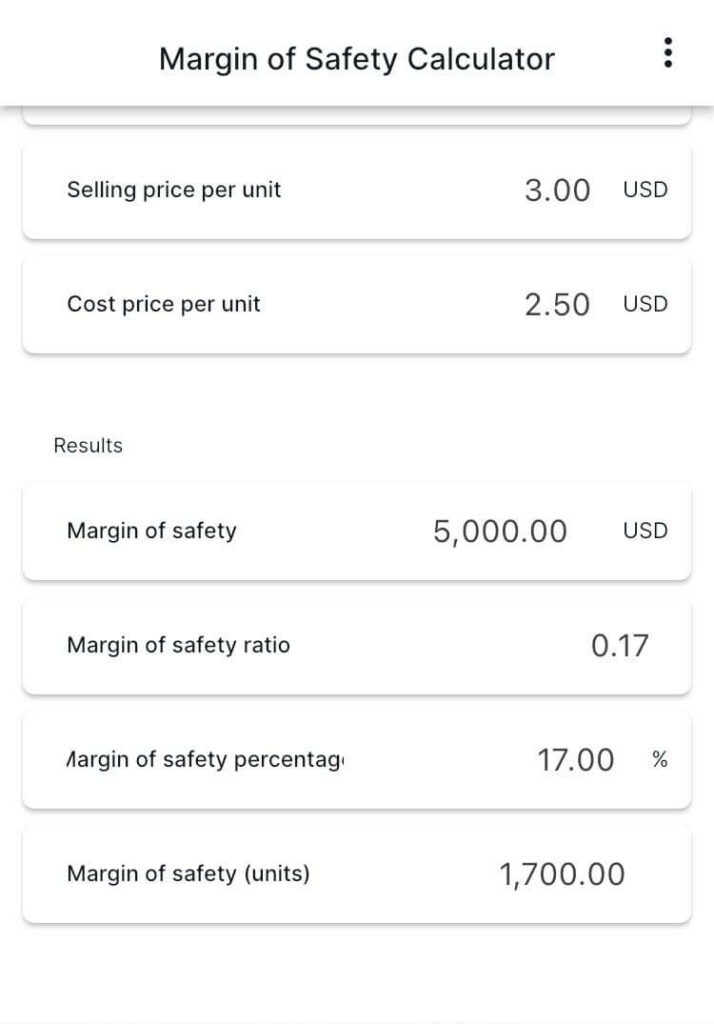

A small bakery decides to calculate its margin of safety to determine if it can afford to invest in more equipment. When they checked their financial statements, they saw that the sales revenue was 30,000$. Meanwhile, the breakeven point is summed up to be 25,000$, obtained from a total of fixed costs and variable expenses. We use our basic formula, take away the breakeven point from current sales, and divide it all by current sales. In this case, the margin of safety is 0.17 or 17%. We can see that this bakery still profits from the business from this result. We put those numbers in our mobile app to ensure this calculation is correct. As we can see in these pictures, the calculations are correct. We also set Sales volume at 10,000, so we also get the margin of safety in units.

FAQ

How to calculate the breakeven sales of a company?

The thing that most people get stuck on is calculating their breakeven sales. Break-even sales represent the dollar amount of revenue at which a business earns zero profit. Calculating it is very simple. You simply divide all fixed expenses of a business by the average contribution margin percentage.

Can the margin of safety be negative?

A negative margin of safety is a rarity, but it is possible. If a business is producing below the breakeven point, it will be making a financial loss, and there is no safety margin. That means that a business has problems in accounting and finance. If the margin of safety is negative, there is a loss situation, and the stock has a lower value.