This cross-price elasticity calculator enables you to calculate the association between the price of one product and the amount sold of a different one. Thanks to this tool, you will be able to rapidly identify whether two items are replacement goods, complementary goods, or maybe wholly uncorrelated products. This post will offer you a cross-price elasticity formula and show you an example of step-by-step computations.

Take a look other related calculators, such as:

- Finance charge calculator

- Net to gross calculator

- Markdown calculator

- Hourly to salary calculator

- Gdp per capita calculator

- Fte calculator

- Margin with discount calculator

- Average rate of change calculator

- Magi calculator

- Consumer surpulus calculator

- Double discount calculator

- Net effective rent calculator

- Marginal Cost calculator

- MPC calculator

- MPS calculator

- Pay Raise calculator

- Pre-Money and Post-Money Calculation

- Stock Calculator

What is the cross-price elasticity of demand?

The cross elasticity of demand is an economic term that assesses the responsiveness in the amount desired of one commodity when the price for another good chance. Also termed cross-price elasticity of demand, this is determined by taking the percentage change in the amount requested of one good and dividing it by the percentage change in the price of the other good. In economics, the cross elasticity of demand refers to how sensitive the demand for a product is to changes in the price of another product.

How to calculate the cross-price elasticity of demand?

Cross-price elasticity evaluates how responsive the demand of a product is over a change of a similar product price. Often, in the market, certain commodities can link to one another. This may indicate a product’s price rise or reduction might favorably or adversely affect the other product’s demand.

Cross Price Elasticity of Demand (XED) evaluates the connection between two items when the price varies. So if a Hershey’s chocolate bar grows by 20 percent, how would that influence the demand for Snickers? In other words, it estimates how the change influences the demand for one product in the price.

Cross price elasticity formula

Now that we know what this statistic reveals, it’s time to learn how to compute it. All you have to do is use the following cross-price elasticity formula:

elasticity = (price₁A + price₂A) / (quantity₁B + quantity₂B) * ΔquantityB / ΔpriceA

Where:

- Qx = Average quantity between the previous quantity and the changed quantity, calculated as (new quantityX + previous quantityX) / 2 \s

- Py = Average price between the previous price and changed price, calculated as (new pricey + previous pricey) / 2 \s

- Δ = The change of price or quantity of product X or Y

Note: In cross-price elasticity, unlike in income elasticity, the ΔQx and ΔPy are determined by calculating the averages between the change in either price or quantity requested.

Understanding the results

You can receive one of three results: a cross-price elasticity coefficient that is positive, negative, or equal to zero.

A positive elasticity is characteristic of alternative commodities. It indicates that as the price of product A grows, the demand for product B increases, too. For example, this may be true for butter and margarine; if butter goes higher, more people choose margarine, boosting the demand.

This effect is most obvious for scenarios in which just two rivals strive to dominate the market.

A negative elasticity is characteristic of complementary items. For example, when the price of product A increases, the demand for product B goes down. A good example would be the coffee machine, and capsules situation discussed earlier. If you increased the price of the coffee machine, fewer people would be tempted to buy the capsules, thereby lowering the demand.

If the elasticity is equal or extremely near to zero, it implies that the two products are uncorrelated. Therefore, the change of price of product A does not alter the demand for product B.

Cross price elasticity of demand graph example

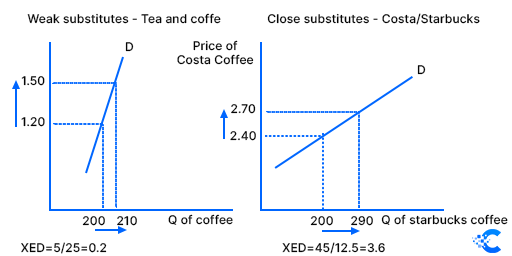

Cross elasticity of demand (XED) quantifies the percentage change in quantity demand for an item after a change in the price. For example: if there is a rise in the price of tea by 10 percent and the amount desired for coffee increases by 2 percent, then the cross elasticity of demand = 2/10 = +0.2

- Substitute products will have a positive cross-elasticity of demand. Weak replacements like tea and coffee will have a low cross elasticity of demand. If the price of tea increases, it will encourage some individuals to switch to coffee. But for most consumers, their choice for a specific drink is more significant than a tiny variation in price.

- Complements will have a negative cross elasticity of demand. For two alternative brands, Starbucks Coffee and Costa Coffee, these items are closer alternatives since the difference is significantly less. If the price of Costa Coffee increases, more people will migrate to an alternative brand such as Starbucks. With close alternatives, the XED will be higher.

- Unrelated items will have a cross-elasticity of demand of zero. The price of apples has little influence on the demand for Apple laptops. The purpose of advertising is to promote brand loyalty and make consumers less eager to move to another brand – even if the price rises.

Cross price elasticity of demand example

Let’s imagine that Coca-Cola decides to cut the price to $0.59. Observe how the demand for Pepsi cans evolved. Let’s imagine it reduced to 600 million cans. Now, all you have to do is use the cross-price elasticity formula:

elasticity = (price₁A + price₂A) / (quantity₁B + quantity₂B) * ΔquantityB / ΔpriceA

= ($0.69 + $0.59) / (680 mln + 600 mln) * 80 mln / $0.10

= $1.28 / 1280 mln * 80 mln / $0.10

= ($1.28 / $0.10) * 80 mln / 1280 mln |

= 12.8 * 0.0625

= 0.8

FAQ

Difference between price and cross elasticity of demand?

Cross price elasticity of demand = percent change in the quantity requested for Good A/percent change in the price of Good B. Whereas, if the cross-price elasticity of demand is a negative value, the two items or services would be complementary goods or services.

Can it be cross-price elasticity negative?

The negative cross elasticity of demand suggests that the demand for good A will drop when the price of B goes up. This signifies that A and B are complementary commodities, such as a printer and printer toner.