If you need an estimate of the portion of revenue that you will require to cover the fixed costs of your business, then you are in the right place. It is a calculator that will help you calculate the contribution margin, provided you have some of the data on the popout selling price per unit, the variable cost per unit, and the number of units in production. You can also use the calculator for the contribution margin ratio, which can be very useful to understand how profitable the business you are doing is. Many world leaders pay attention to the profit margin, which aims to measure how income exceeds the level of realized costs. To apply this practice to your business, read more information about this handy calculator below.

What is the contribution margin?

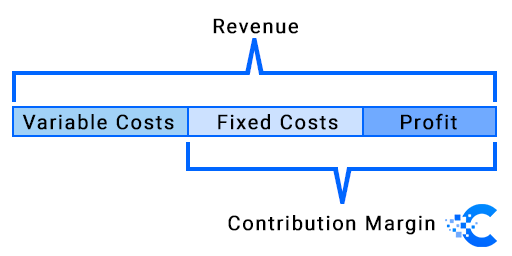

This term can be interpreted in many ways. The usual definition of the term refers to the fact that when you subtract the variable cost of product delivery after producing a particular product, the remaining revenue is called the margin contribution. The bottom line is that the contribution margin shows the total revenue available after variable costs spent to cover fixed costs and ensure profits. Simply put, it is the amount of money that a company can generate per unit of the product after deducting the number of variable costs. The amount obtained using this calculator can be used to cover fixed costs and can be expressed in percentages or absolute numbers. This is one way to show the profit potential of a manufactured product.

How to calculate the contribution margin and the contribution margin ratio?

When it comes to calculating the contribution margin, this is done straightforwardly. You need to multiply the sales price per unit by the number of units sold to get sales revenue. After that calculation, you need to multiply the variable costs per unit by the number of units to get the total variable costs. You enter the calculated data into our calculator, and the contribution margin will be calculated automatically, subtracting the amount of sales revenue from variable costs. If you need to express the data in percentages, you need to use another formula. To calculate the contribution margin ratio, you need to divide the received contribution margin by sales revenue.

Before entering data into the contribution margin calculator, you need to distinguish between fixed and variable costs. The group of variable costs includes those costs whose amount varies with the number of products produced. Variable costs are also said to be direct/indirect expenditures incurred in producing goods and services. They increase as production increases and decrease as production decreases. Some variable costs are raw materials used to produce goods, oils, and lubricants used to maintain machinery, the number of wages per worker per unit of labor, commissions to sellers for each unit sold, and the cost of entry/exit of goods. The importance of correctly calculating and classifying variable and fixed costs is key to achieving product profitability.

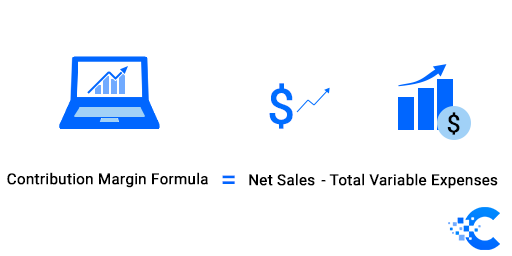

Contribution margin formula

The formula’s simplicity for calculating the contribution margin is reflected in several necessary data and steps.

Contribution \; Margin = Sales \; Revenue - Variable \; Costsor

Contribution \; Margin = Fixed \; Costs + Net \; Income

Using the contribution margin formulas – example

In the following classic case study, we will show how to calculate the contribution margin using this calculator.

Imagine you are a mobile retailer. You sold 100,000 units of the latest product generation in your product range during the year. The established selling price per unit of product is $ 150, with a variable cost of $ 60 and a variable administrative cost of $ 20. According to the established formula, the contribution margin for each product sold would be $ 70, and the contribution margin ratio is 0.47 or expressed as a percentage of 47%.

CM – Contribution margin

CMR – Contribution margin ratio

CM = 150 - 80

CM = \$ 70

CMR = \frac{70}{150}

CMR = 0.47\cdot 100 = 47 \%

Contribution margin vs gross margin

It is essential to distinguish between the concept of contribution margin and gross margin, and you can find out what it is about below. Gross margin measures the amount of revenue generated after deducting costs directly related to production, while the term contribution margin is a measure associated with the realization of product profitability. One of the key differences is that the contribution margin calculation does not include fixed costs, while the gross margin does. Following this thought, we can conclude that the contribution margin will always be greater than the amount of the gross margin. Fixed administrative costs are not included in the contribution margin calculation because they change according to sales. It is also important to point out that with the gross margin, you can express the profitability of the entire business of the company. In contrast, with the contribution margin, you represent the profitability of the target product or product line.