The assessment of industrial investment projects in well-developed countries is based on traditional and new, more rational methods that can be characterized as reliable and proven methods. We can then single out a unique term, more precisely an economic indicator called the profitability index. This indicator has proven to be excellent in assessing the economic effects of projects or companies in all aspects of the business. The focus is on measuring the cost-effectiveness assessment and quantifying the effectiveness of a particular investment. You can find out more about the calculation method and examples of using the profitability index below.

What is the profitability index?

It is a measure that companies use to determine the cost-benefit ratio before deciding to embark on more complex projects or investments. The Profitability Index (PI) bears an alternative name known by the acronym VIR, which denotes the ratio of investment value or investment to profit. If you do not know how to calculate profit, here is a great Profit Calculator you can use for that purpose.

We can say that the profitability index measures the attractiveness of future projects. It is instrumental in ranking different projects because it provides data in the form of quantified values created per individual investment unit. If there is an increase in the value of the profitability index, it is a sign that the financial attractiveness of the project is growing. This is one of the most used estimating capital inflows with capital outflows to determine project profitability. With the help of this tool, method, or indicator, we can more easily decide whether a particular investment is acceptable or not.

Profitability index formula

Profitability \; Index = \frac{Present \; Value \; of \; Future \; Cash \; Flows} {Initial \; Investment}According to the formula, the profitability index is equal to the fraction of the present value of future cash flows that occupies the position of the numerator and the required investments contained in the denominator. When it comes to the numerator, it involves calculating the time value of money, where cash flows are discounted in a certain number of periods. The discounting process explains in more detail the logic that tells us that the value of 1 monetary unit per day is not equal to the value of 1 monetary unit per year. Essentially, the cash flows we receive in the distant future will carry a lower value than the money we receive in the present. As far as the denominator is concerned, this is the initial required investment, supplemented by additional expenditures that may occur at any time since the project is implemented and are accounted for using discounting in the numerator position.

What is the profitability index rule?

When determining the profitability index, it is necessary to follow specific established rules. The PI rule helps to assess the success of the project implementation. The formula used to calculate the PI is the present value of future cash flows divided by the initial amount invested in the project.

Therefore, we can conclude that:

- if the profitability index (PI) is higher than 1 – the company will have a chance to continue with the project

- If the profitability index (PI) is less than 1 – the company is unlikely to continue investing in the selected project,

- When the profitability index (PI) is equal to 1 – the company becomes indifferent when choosing whether to continue with the project.

How to calculate profitability index?

Based on the formula we explained earlier, the profitability index is calculated. We need to be careful that the impact of the value of the profitability index should not significantly affect our decision to continue project implementation, even in cases where the PI is greater than 1. It would be best to consider other options before the final performance. Many analysts also use PI in combination with other analysis methods, such as net present value (NPV), which we will discuss later. As for calculating the PI and its interpretation, it is essential to differentiate some things. The amount of the profitability index obtained cannot be negative but must be converted into positive figures to be useful. Amounts greater than 1 show that future expected cash inflows are higher than expected. Amounts less than one indicates that the project should not be accepted, while a situation where the amount obtained is equal to 1 lead to minimal losses or gains from the project. Amounts greater than 1 are positioned based on the most significant amount realized. If the initial capital is limited, a project with a higher profitability index is accepted because it has the most productive available money. That is why this indicator is called the benefit-cost ratio.

What is the difference between NPV and PI?

Many analysts are confused by the interpretation of these indicators. The profitability index is similar to calculating the net present value (NPV), with some differences. The main difference between these two methods is that PI is presented as a ratio so that it will not directly indicate the size of the cash flow. The calculation of NPV is carried out in several steps. First, it is necessary to identify all cash inflows and outflows, determine the discount rate, find the present value of these cash inflows and outflows, and add up all the obtained current values. From this process, we see that the NPV shows us the project’s cost-effectiveness compared to other projects. Both methods consider the cash flow elements of a project. However, NPV is expressed in monetary units, while PI gives the value ratio. The profitability index is an absolute value and does not suggest a possible achievable amount in monetary units. Therefore, these two indicators are most often used in combination to determine the success of a project’s survival more accurately.

How to calculate PI when the PV of future cash flows is known – Example

The first way to calculate PI is if we have known data on the present value of future cash flows (PV):

Let’s assume that the initial investment for expanding a company that sells washing machines is $ 500,000. After five years of the project, cash flows have been discounted at a rate of 10%, and the total present value is $ 800,000.

By putting all the data in the formula for calculating the PI, we get the following value:

PI = \frac{800,000}{500,000} PI = 1.6Based on the obtained data, we can conclude that the realization of this project can continue according to the rule of the profitability index.

How to calculate PI when the PV of future cash flows is not given – Example

The second situation of calculating the profitability index is related to the fact that we do not know the data on the present value of future cash flows. Still, it is necessary to calculate them, and as you can see below:

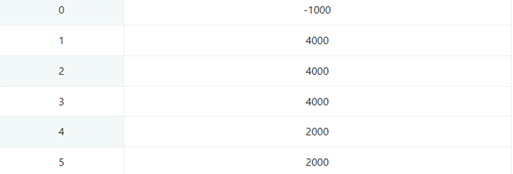

We will take as an example the situation that a company called ZED is investing in a newly designed project. Their initial stake is $ 10,000. You can see the expected cash inflow for the next 5 years in the table below:

The next step is to calculate the present value of future flows by calculating the discounted cash flow for each year.

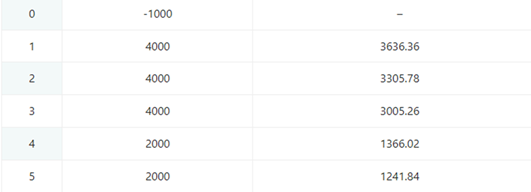

The procedure for obtaining the amount in the table above was done so that we took separate present values of future cash flows and discounted them at a rate of 10%.

PV = \frac{FV}{(1+i)^{1}}

PV = \frac{4000}{(1+0.1)^{1}}

PV = \frac{4000}{1.1}

PV = 3636.36

The procedure is repeated for each year separately. After that, we need to get the total amount of PV of future cash flows so that we will add up the obtained amounts for all five years. We will then include this amount in the initial formula for the position of the numerator. At the same time, we will have the amount of the initial investment in the position of the denominator.

PI = PV of future cash flows / Initial investment

PI = \frac{12555.26}{10000}

PI = 1.6

Benefits and limitations of profitability index

When we talk about the advantages of using this indicator, they are numerous. It is one of the most desirable instructions for performing a budget because, unlike other indicators, it directly indicates the ratio instead of the numbers. It gives users an insight into the value per unit of investment. Its ease of use helps companies and analysts rank projects according to their (un) cost-effectiveness. When calculating, it considers the time value of money, which clearly shows whether a certain investment will result in a positive or negative value. In contrast, the negative aspects of using PI indicators are that the project’s total size is not taken into account. It is mainly used in estimating the cost of capital which may not always be accurate as it is an estimate. This unreliability is one of the most common problems in selecting mutually exclusive projects with the same PI value achieved.